- Home

- Property Search

- About Us

- Valuation

- Land & New Homes

- Sales

- Lettings

- Team

- Our Mission

- Careers

- Blog

- Sponsorship

- Contact Us

- Battersea and Clapham020 7228 5111

- Wandsworth020 3846 0999

- Balham and Tooting020 8767 7079

- Earlsfield020 8879 6205

- Lettings020 7978 4404

- Property Management020 8125 7124

- New Homes020 8125 3040

- Emergency/Out of Hours ContactClick Here

We spend a lot of time discussing the housing market in these missives, and by that, I mean the sales market.

And I guess that’s understandable for, as a nation dedicated to the notion of homeownership, property market reportage is big news.

Indeed, if it weren’t for the volatility of the housing sales market, the Daily Express would surely cease to exist…

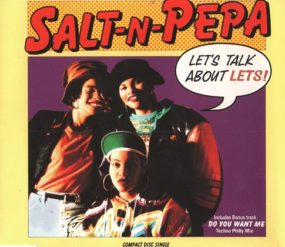

So, let’s talk about Lets (bay-bee..) because, recently the lettings market has been grabbing the headlines at Rampton Baseley

- Business signed off for August is up 97% YOY (this is three weeks before the month actually begins!).

- 93% of those deals have gone at over asking price!

But here’s the interesting bit – this surge in business has come from half as many deals.

What? How?

It can’t surely all be down to the brilliance of the RB lettings department, can it? (Well, to an extent it can, but I’ll do the PR later).

No, it’s not entirely us.

We used the word “market” a lot up there and this word signals the oncoming, dreary spectre of Economics…

What does the breeze block of the academic world tell us?

That demand is outstripping supply.

Rents have risen around 12% YOY due to a supply/demand imbalance – zzzzzz…

There you go, economics – grey, lumpy, stolid, factual stuff..

The Dismal Science. A science famously described by Friedrich von Hayek as “the painful elaboration of the (bleeding) obvious…”

So, let’s add some colour to the foggy drear of economics. Let’s use mauve, for mauve is the colour of behaviour. And if you add the word behavioural to the word economics, you get a subject bordering on the interesting.

Because, what’s really interesting (well, I think it is), is WHY has the supply/demand balance shifted, and why have individual transaction values risen so absurdly? (Could why be the most important word in the English language? And if so, why? Another time perhaps…?)

Why?

Because of the way people have behaved. Their behaviour has adjusted the economic equation of supply and demand.

Let’s first deal with supply.

Why is supply, according to our research, down to the tune of 28% YOY?

For a long while now, at least since Glorious George Osborne was at No 11, the government has gone after the Buy-To-Let Landlord; we’ve seen tax changes, more and tighter regulations and lending restrictions, all combining to make BTL increasingly untenable. It is thought that the government is doing this to reduce competition for first-time-buyers (politically expedient as homeowners are more naturally Tory voters – releasing buy-to-let portfolios to eager first-time buyers swells the Boris Massive).

Also, landlords form a relatively small, unpopular, yet cash-rich voting contingent. If we bear in mind the words of Colbert (Louis XIV’s finance minister), ‘The art of taxation is to pluck the goose by procuring the largest quantity of feathers with the least amount of hissing,’ then BTL landlords represent a very attractive target group (of feathers)

So, the government, being the bunch of pluckers they are, makes some easy money and adds political hue to the electorate.

Two birds (geese?), one stone.

Point 1 – life as a Wandsworth property landlord has been getting pretty tiresome recently.

Point 2 – life as a Wandsworth property seller has been getting pretty exciting recently.

The post-Covid sales market surge has seen prices rise around 10%. So, as a landlord it’s a great time to cash in your chips.

Combine point one and point two and you have very strong motivation for landlords to exit the market.

There’s your supply reduction.

Here’s your demand increase…

- A surge of people returning to the capital from the country post-Covid – kids escaping from MnD again, and Londoners realising that it was all just a terrible mistake (the Move to The Country, that is)

- A swathe of tenants being kicked out by their landlords as they cash in their chips (see above)

- Loads of local people renovating properties and so needing temporary accommodation (Covid partially suspended the building game, allowed UK households to save up an estimated £175bn, and lockdown helped them realise the current house wasn’t fit for purpose).

- People ducking out of buying, it’s all got a bit rich for them and they see storm clouds on the horizon.

So, there’s your 12% increase in rental values.

But where’s my four-fold increase in transactional values?

Here we really are getting all interesting and mauve.

No one, not even a cheesy, let’s-talk-the-market-up-at-all-times-and-costs estate agent like me, can deny that there’s a storm on the economic horizon.

Tenants know this and landlords know this. So, they’re both angling for longer tenancies – two years generally – time enough to hunker down somewhere safe and ride out the storm. Bearing in mind the supply shortage, tenants are pushing this hard, making themselves as attractive as possible.

And now the skilful agent steps in (this is the PR bit btw).

Firstly, you have to set an asking price that at once reflects the rising market value, but at the same time doesn’t scare off the renting population. A price that engenders maximum interest from maximum parties, yielding maximum rent.

Then the skilful agent elicits maximum fringe benefits from the assembly of eager tenants – lack of break clauses, longer tenancies, and higher RPI-based future rent rises.

Once you have done this, you then go through references, affordability checks and, impressions made, and you pick your ideal tenants – jolly nice people, with jolly good jobs, paying a jolly good rent, for a jolly long time. Result, jolly happy landlord.

This is what a good lettings agent does. This is what Rampton Baseley does.

Trust me, I’m an estate – sorry – lettings agent.